About Outsourcing

Why to outsource?

From last two decades, there is considerable short supply of the accounting professionals in Australia. Lot of accountants and bookkeepers in Australia are facing a major challenge in finding talented manpower to support their business. Further the cost of inhouse staff is considerably increased and for many accountants, hiring the inhouse staff is becoming an uneconomical business. The demand for accountants’ services is growing well and accountants doing good business, but not able to deliver the services on time due to shortage of experienced staff.

Outsourcing is a great solution to address this problem. Through outsourcing, accountants and bookkeepers are getting the experienced staff at considerably lower cost. From last 10 years, more than 60% of the accountants and bookkeepers in Australia have adopted the outsourcing. As a result, they are able to grow their business significantly.

Small accounting firms started outsourcing their majority of the bookkeeping and financial work and started investing their valuable time on business advisory services, other value-added services to their clients and focusing more on marketing and growing their practice. Medius size and bigger accounting firms are saving the cost of operation to a great extent. In fact many bigger accounting firms have set up their own outsourcing unit in other countries with more manpower.

How is it beneficial?

- The Best Staffing Solution - Supply of experienced staff as and when you need. Very much flexible to onboard and offboard.

- Cost effective – Cost of outsourced staff will be considerably lower than the inhouse staff.

- Zero Attrition – Outsourced accountant will not change the job and will not retire. That means, the arrangement is long term. The change of staff will be done by replacement of experienced staff and well training and handover. Our managers will play a major role here by bridging the gap. Effectively, once outsourced staff starts, he will continue indefinitely.

- We will train and monitor your team member – You don’t need to train the outsourced staff and we will do that on your behalf. Our manages will review the work and ensure the quality of service is excellent. Simultaneously, they will do the job training to the staff.

- No long-term commitment - If you don’t have enough work for the outsourced staff, you can easily terminate the contract.

That way, they will work closely with your team and you don’t need to spend time to allocate the work and organise the documents. They will themselves will access the documents and emails and communicate with your clients directly if you wish and get the work completed with not much effort from your end. The staff will also update the time sheet and the job status in your workflow or the time tracking application as per the requirement in your firm.

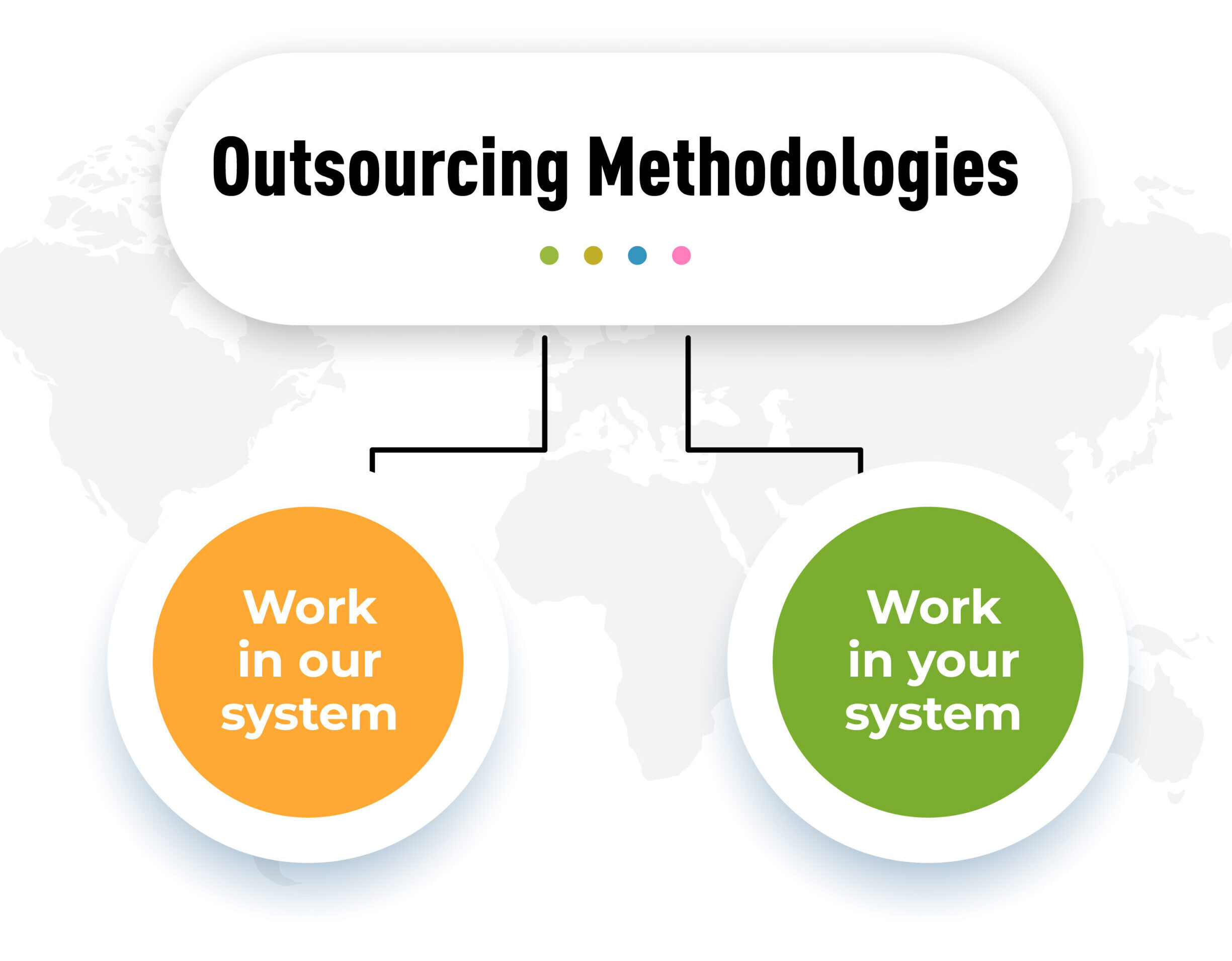

Outsourcing Methodologies

Generally, there are 2 outsourcing methodologies:

Work in our system

- We will use an application to share the data between your office and our office. We use Email/ Dropbox/ One Drive, and few other applications.

- When allocating the work, you are required to save the source documents in the shared folder.

- You are required to give access to the accounting and tax software.

- We will process the job in our local system and send you the queries via email.

- Once you reply for the queries, we will complete the work and save the complete work files including the reports and work papers in the shared folder.

Work in your system

- You will give access to your office system or remote server.

- We will login to your server and get access to the accounting and tax software and documents.

- We will process in your system/server and send you the queries.

- Once the queries are replied, we will complete the work and all the reports and work papers are in your system itself and no further copying is required.

What will be your cost?

Basically there are two ways the work is handled and you will be billed.

Job wise

In this model, you will allocate a particular work (job). As and when you have the work, you will allocate the work. We will send the estimated time to complete the job and request your approval. Once you approve the same, we will process the job and complete the same. The standard fee per hour will be set in the contract. The total fee chargeable to you will be calculated by multiplying the estimated time with the hourly fee.

Dedicated staff

This is more popular model. One staff is allocated to you on dedicated basis. He/She will work exclusively on your work 8hrs a day and 5 days a week. They will be in touch with you over the Teams/Skype/Whatspp/other chat apps and also in phone/Googlemeet/Zoom as per your preference. You can get all kinds of work, including partly completed work, admin work and all. You will be billed fixed fee per month.

This is very popular, because this works exactly the same way as your inhouse staff working from home. He/she will be familiar with your firm procedures and practices, work papers, document filing and related admin works.

That way, they will work closely with your team and you don’t need to spend time to allocate the work and organise the documents. They will themselves will access the documents and emails and communicate with your clients directly if you wish and get the work completed with not much effort from your end. The staff will also update the time sheet and the job status in your workflow or the time tracking application as per the requirement in your firm.